How does the FinTech impact on the business and private clients?

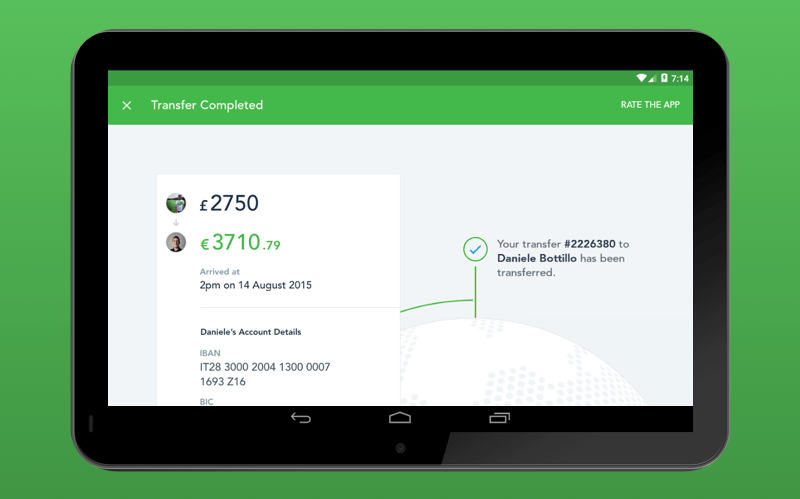

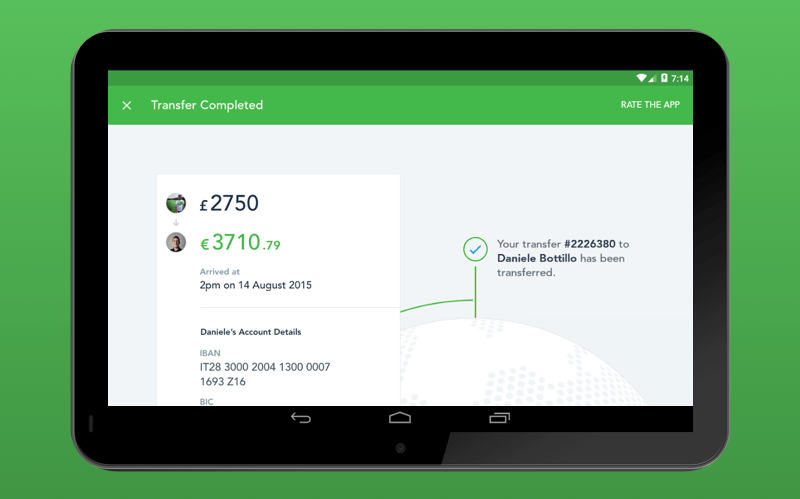

Advancing technology has started influencing the BFSI sector, and we witness innovative app solutions in financial services.

These solutions fall under the fintech category and contribute to improving services.

Mobile wallets, banking apps, and cryptocurrency-related apps are some of the most popular examples of fintech apps.

In this blog, we are going to understand the role and benefits of cross-platform app development for a fintech firm

The right financial software development services company to deliver cutting-edge financial software development.

Checkout Fintech Trends 2021The COVID-19 pandemic presented the FinTech industry with a unique opportunity by fast-tracking from traditional banking to widespread digitalization of financial services.

FinTech innovation is experiencing acceleration to enable financial services companies and their customers to mitigate risks and seamlessly manage their finances.

Let’s look at some of the hottest financial software development trends for 2021, including biometric security, phygital banking, and open banking.

Considering Python web development, security is the essential factor of any FinTech application.

Also, its libraries and the data science ecosystem are ideal for Fintech products.

Python development is a quick fix and one-stop solution that answers all your fintech requirements.

Read more: Why Python Is the Best Language to Develop Amazing Fintech Products

The financial and banking systems have always used traditional approaches to customer experience.

More and more companies are beginning to talk about the importance of financial inclusion, which means equal access to financial services for all social groups.

To overcome these problems, many fintech companies come up with new solutions and technologies, you need to find https://fireart.studio/blog/top-10-fintech-software-development-companies-2021/ a reliable fintech development partner for your project.Expansion of the functionality of applicationsPeople are becoming more demanding.

Further - more: banking applications can add the functionality of registration of insurance for a car, registration of real estate transactions and delivery of goods to your home.Business automationDoing business requires regular complex operations and paperwork.

Online banking will give customers the ability to receive electronic checks and invoices (although these are increasingly being created online).

This frees you from the hassle and allows you to focus on more important things than filling out and sorting hundreds of pages of documents.Blockchain technologyThe blockchain appeared several years ago, so we just have to make the most of its capabilities.

The right financial software development services company to deliver cutting-edge financial software development.

Checkout Fintech Trends 2021The COVID-19 pandemic presented the FinTech industry with a unique opportunity by fast-tracking from traditional banking to widespread digitalization of financial services.

FinTech innovation is experiencing acceleration to enable financial services companies and their customers to mitigate risks and seamlessly manage their finances.

Let’s look at some of the hottest financial software development trends for 2021, including biometric security, phygital banking, and open banking.

Considering Python web development, security is the essential factor of any FinTech application.

Also, its libraries and the data science ecosystem are ideal for Fintech products.

Python development is a quick fix and one-stop solution that answers all your fintech requirements.

Read more: Why Python Is the Best Language to Develop Amazing Fintech Products

The financial and banking systems have always used traditional approaches to customer experience.

More and more companies are beginning to talk about the importance of financial inclusion, which means equal access to financial services for all social groups.

To overcome these problems, many fintech companies come up with new solutions and technologies, you need to find https://fireart.studio/blog/top-10-fintech-software-development-companies-2021/ a reliable fintech development partner for your project.Expansion of the functionality of applicationsPeople are becoming more demanding.

Further - more: banking applications can add the functionality of registration of insurance for a car, registration of real estate transactions and delivery of goods to your home.Business automationDoing business requires regular complex operations and paperwork.

Online banking will give customers the ability to receive electronic checks and invoices (although these are increasingly being created online).

This frees you from the hassle and allows you to focus on more important things than filling out and sorting hundreds of pages of documents.Blockchain technologyThe blockchain appeared several years ago, so we just have to make the most of its capabilities.

Advancing technology has started influencing the BFSI sector, and we witness innovative app solutions in financial services.

These solutions fall under the fintech category and contribute to improving services.

Mobile wallets, banking apps, and cryptocurrency-related apps are some of the most popular examples of fintech apps.

In this blog, we are going to understand the role and benefits of cross-platform app development for a fintech firm